Understanding what is debit and credit in accounting forms the foundation of every successful bookkeeping system. These two concepts work together to track money flowing into and out of your business accounts, ensuring your financial records remain accurate and balanced. For many business owners and accounting students, in accounting what is debit and credit becomes clearer when you understand that these terms describe the direction of value movement rather than simply adding or subtracting money. This guide breaks down what is a debit and credit in accounting using simple explanations and practical examples.

Understanding Double-Entry Accounting

Debits and credits form the backbone of the double-entry accounting system used by businesses worldwide.

The Balance Principle

Double-entry accounting requires that every financial transaction affects at least two accounts. For every debit recorded, there must be an equal credit recorded elsewhere. This balance principle serves as a built-in error-checking mechanism, helping identify mistakes before they compound. When studying accounting basics, many students find these concepts more approachable than wondering is statistics hard by comparison.

Why It Matters

Unlike single-entry bookkeeping, double-entry accounting shows the full impact of each transaction. When you purchase equipment, your records show both the increase in assets and the decrease in cash. Banks and investors prefer this method because it produces reliable financial statements.

Recording Transactions Correctly

Every business transaction must be analyzed before recording to determine which accounts are affected. Ask yourself what your business received and what it gave up in exchange. This simple analysis helps you identify the correct debit and credit entries every time. Consistent application of this approach ensures your financial records remain accurate and audit-ready.

What Are Debits and Credits?

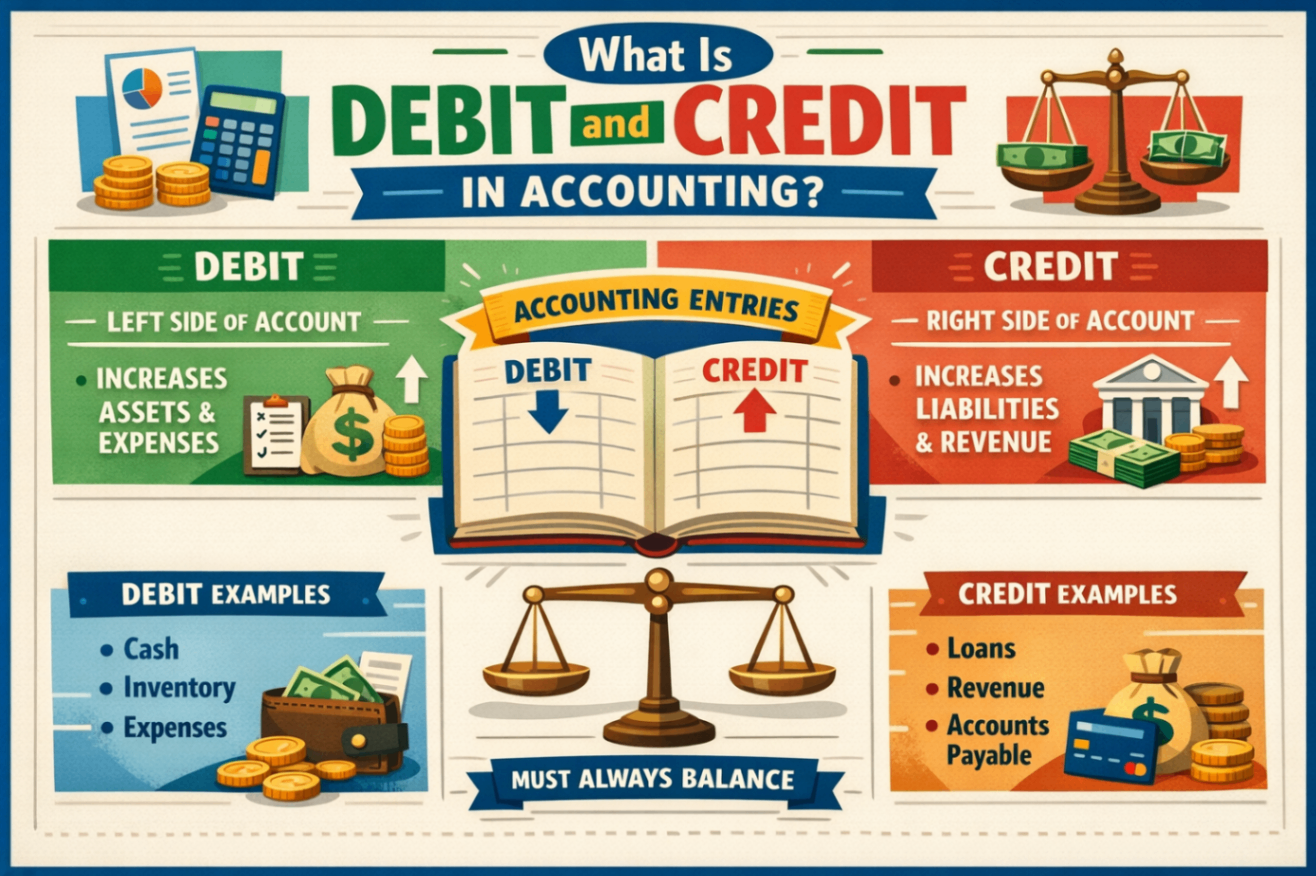

Understanding what is credit and debit in accounting requires knowing how each affects different account types.

Debits Explained

A debit (abbreviated DR) records value flowing into certain types of accounts, appearing on the left side of journal entries. Debits increase asset, expense, and loss accounts while decreasing liability, equity, and revenue accounts. When your business receives cash from a customer, you debit your cash account because money flows into that asset.

Credits Explained

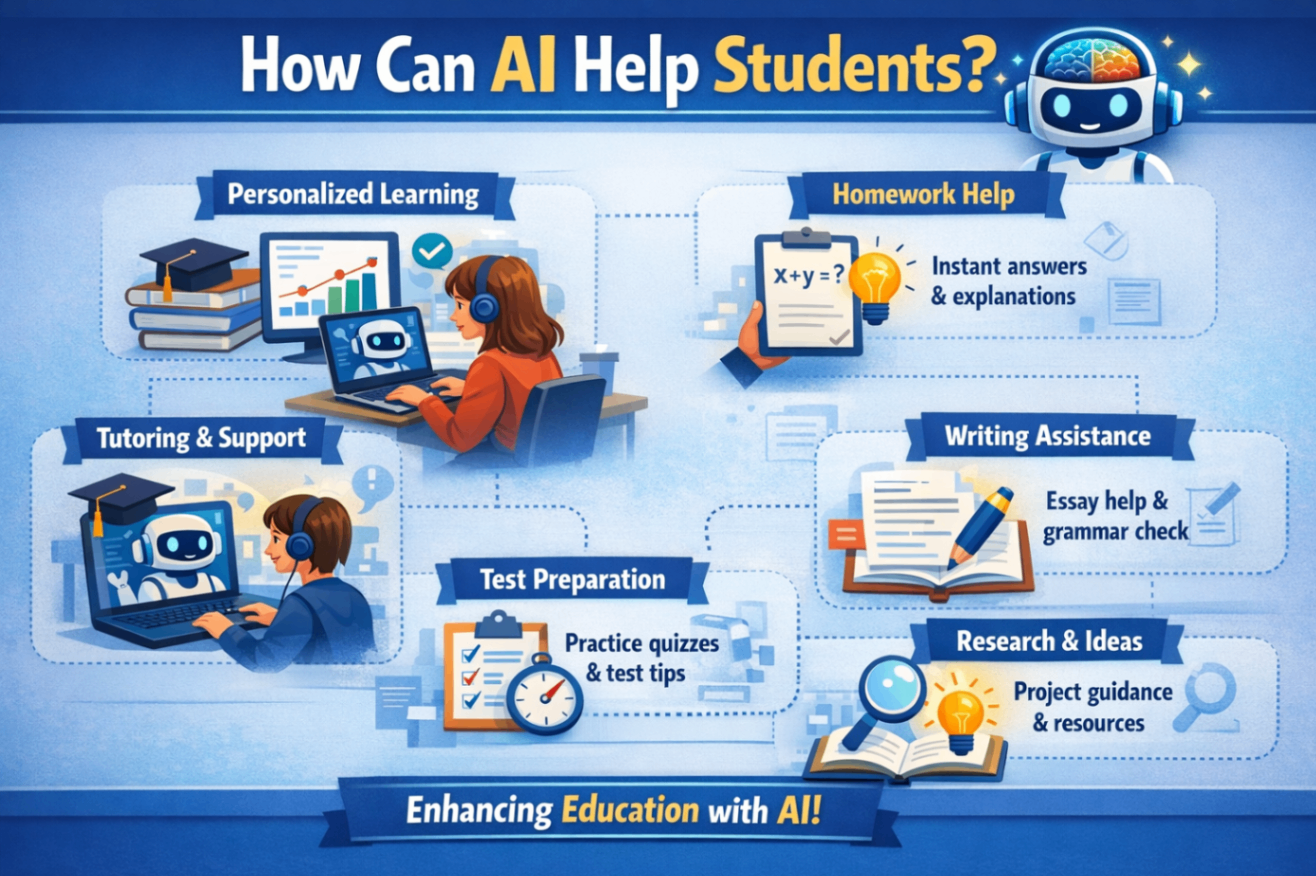

A credit (abbreviated CR) records value flowing out of certain accounts or increasing balances in liability, equity, and revenue accounts. Credits appear on the right side of journal entries. When you record a sale, you credit your revenue account because earnings increase. Using an Accounting AI Solver can help verify your entries are correct.

Common Debit and Credit Entries

Most businesses record similar types of transactions repeatedly throughout each accounting period. Cash receipts from customers always debit the cash account while crediting either sales revenue or accounts receivable. Paying bills always credits cash while debiting either an expense account or accounts payable. Recognizing these patterns makes daily bookkeeping faster and more accurate over time.

What Is the Difference Between Debit and Credit in Accounting?

Understanding what is the difference between debit and credit in accounting helps clarify how these concepts work together.

Effect on Account Types

The key difference lies in how debits and credits affect various account types. Debits increase asset and expense accounts but decrease liability, equity, and revenue accounts. Credits do the opposite, increasing liability, equity, and revenue accounts while decreasing asset and expense accounts.

The Yin and Yang Relationship

Think of debits and credits as accounting's yin and yang—opposite forces working together to create balance. Neither exists without the other, and every transaction requires both to maintain equilibrium.

Left Side vs Right Side

Debits always appear on the left side of journal entries while credits always appear on the right side. This positioning never changes regardless of the account type or transaction nature. Memorizing this simple rule helps you record entries correctly every time. The left-right convention has remained consistent since double-entry bookkeeping was first developed centuries ago.

How Different Accounts Are Affected

Different account categories respond differently to debit and credit entries.

Asset and Expense Accounts

Asset accounts like cash, inventory, and equipment increase with debits and decrease with credits. Expense accounts including rent, salaries, and utilities also increase with debits. When you receive money or incur costs, you debit these accounts.

Liability, Equity, and Revenue Accounts

Liability accounts like accounts payable and loans payable increase with credits and decrease with debits. Equity and revenue accounts follow the same pattern. When you take on debt, earn revenue, or receive owner investments, you credit these accounts.

Memorizing Account Behavior

A helpful memory trick is remembering that accounts on the left side of the accounting equation increase with debits. Assets appear on the left, so they increase with debits. Liabilities and equity appear on the right side of the equation, so they increase with credits. Revenue increases equity, so it also increases with credits. Expenses decrease equity, so they increase with debits.

Practical Examples

Real-world examples illustrate what is a debit and credit in accounting more clearly than abstract definitions.

Cash Sale Example

When your business sells a product for $500 cash, you debit the cash account for $500 (asset increasing) and credit sales revenue for $500 (revenue increasing). Both sides equal $500, maintaining balance.

Purchasing on Credit Example

When you buy $2,000 of equipment on credit, you debit equipment for $2,000 (asset increasing) and credit accounts payable for $2,000 (liability increasing). No cash changes hands, yet your books balance.

Paying Off a Loan Example

When your business pays $1,000 toward a bank loan, you debit loans payable for $1,000 (liability decreasing) and credit cash for $1,000 (asset decreasing). This transaction reduces both what you owe and what you have in the bank. The entry shows money leaving your cash account while simultaneously reducing your debt obligation to the lender.

Recording Expense Payments

When your business pays monthly rent of $1,500, you debit rent expense for $1,500 and credit cash for $1,500. The debit increases your expense account, which ultimately reduces your net income for the period. The credit decreases your cash asset account, reflecting money leaving your business. This type of entry occurs frequently for utilities, insurance, supplies, and other regular business expenses.

Conclusion

Understanding what is debit and credit in accounting provides the foundation for all financial record-keeping. Remember that debits increase asset and expense accounts while credits increase liability, equity, and revenue accounts. Mastering these concepts opens doors to deeper financial literacy. With practice, recording debits and credits becomes second nature, allowing you to focus on analyzing your business performance rather than struggling with basic entries. Start with simple transactions and gradually work your way up to more complex scenarios involving multiple accounts.

Frequently Asked Questions

What is debit and credit in accounting?

In accounting, a debit (DR) records value flowing into asset, expense, and loss accounts, appearing on the left side of journal entries. A credit (CR) records value flowing into liability, equity, and revenue accounts, appearing on the right side. Together, they form double-entry accounting where every transaction requires equal debits and credits. This system has been used by businesses worldwide for over 500 years because it reliably tracks financial activity and catches errors automatically.

What is the difference between debit and credit in accounting?

Debits increase asset, expense, and loss accounts while decreasing liability, equity, and revenue accounts. Credits do the opposite. Debits always appear on the left side of entries while credits appear on the right side of journal entries. The key is understanding which account type you are working with before determining whether to debit or credit it.

Which accounts increase with debits and which increase with credits?

Asset accounts, expense accounts, and loss accounts increase with debits. Liability accounts, equity accounts, revenue accounts, and gain accounts increase with credits. This relationship remains constant regardless of transaction type. Understanding these rules helps you record any business transaction accurately without confusion.

Why do debits and credits need to balance?

Debits and credits must balance because double-entry accounting requires every transaction to affect at least two accounts equally. This balance principle serves as a built-in error-checking mechanism. When your books don't balance, you know immediately that a mistake exists somewhere and can investigate before it causes larger problems.

How do debits and credits differ from personal banking terms?

In personal banking, debiting removes money from your account. In accounting, debits often represent positive additions to asset accounts. Credits in banking add money, but in accounting, crediting cash means money is leaving. This difference exists because banks record transactions from their perspective, not yours, which is why the terminology seems reversed.