Table of contents

- What Is Financial Accounting Definition

- What Is the Primary Purpose of Financial Accounting

- What Is Principles of Financial Accounting

- Key Financial Statements in Financial Accounting

- The Double-Entry Accounting System

- Accrual Versus Cash Basis Accounting

- The Financial Accounting Process

- Careers in Financial Accounting

- Conclusion

Financial accounting serves as the backbone of modern business operations, providing essential insights into organizational financial health and performance that stakeholders need for critical decision-making. This specialized branch of accounting focuses on preparing standardized financial statements that communicate a company's economic activities to external parties including investors, creditors, regulators, and the general public. Understanding what is financial accounting represents a crucial first step for anyone involved in business operations, investment analysis, or financial management. Unlike other accounting branches that serve internal management needs, financial accounting emphasizes transparent, standardized reporting that enables comparisons across companies and industries. This systematic approach to recording, summarizing, and reporting financial transactions follows established principles and regulatory frameworks that ensure information remains consistent, reliable, and useful for decision-making. This comprehensive guide explores the definition, core purposes, fundamental principles, and practical applications that make financial accounting indispensable in today's business environment.

What Is Financial Accounting Definition

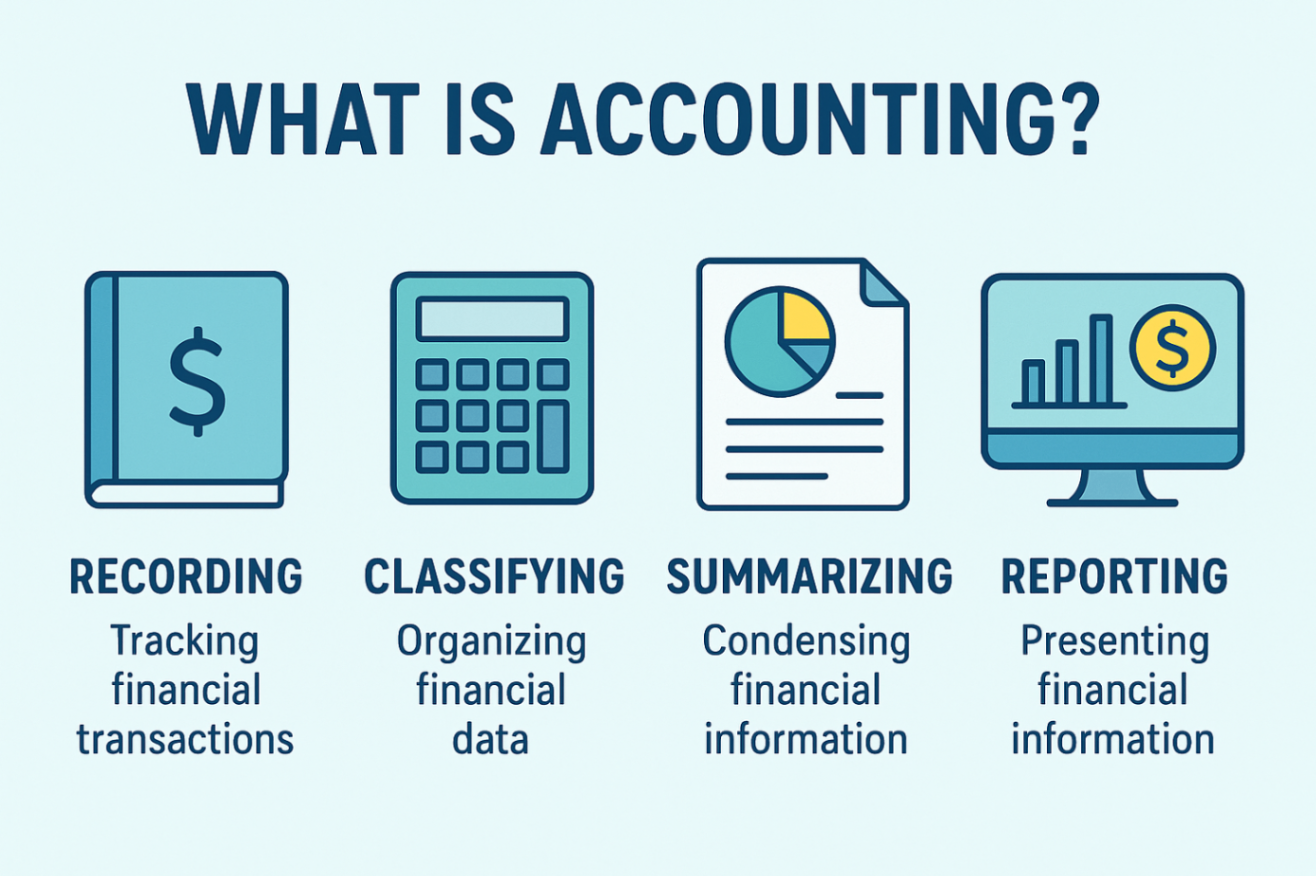

Financial accounting is a branch of accounting concerned with the summary, analysis and reporting of financial transactions related to a business. More specifically, financial accounting is a branch of accounting focused on recording and summarizing business transactions to prepare financial statements that reflect a company's performance and financial position.

The Core Components of Financial Accounting

Financial accounting represents the systematic process of preparing financial statements that companies use to communicate their financial performance and position to external stakeholders. This involves the preparation of financial statements available for public use, serving stockholders, suppliers, banks, employees, government agencies, business owners, and other stakeholders who need information for decision-making purposes. Understanding what is financial accounting in simple words means recognizing it as the process of collecting financial data about a business's economic activities, organizing that information according to established rules, and presenting it in standardized reports that external parties can understand and use. These reports tell the financial story of a business, revealing profitability, financial position, cash flows, and changes in ownership equity.

Financial Accounting Versus Other Accounting Types

While managerial accounting provides accounting information to help managers make decisions to manage the business, financial accounting serves external audiences with standardized reports. This fundamental distinction shapes everything about how financial accounting operates—the standards it follows, the formats it uses, and the level of detail it provides. Financial accounting differs from specialized areas like what is cost accounting, which focuses specifically on analyzing costs of production and operations for internal management. Financial accounting takes a broader view, encompassing all financial activities and presenting them in comprehensive statements that provide complete pictures of organizational finances.

Why Financial Accounting Matters

Investors, lenders, and shareholders all depend on financial statements to assess a company's profitability, stability, and growth potential. Without financial accounting's systematic approach, these external parties would lack reliable information for making critical economic decisions about where to invest capital, whether to extend credit, and how to value businesses.

What Is the Primary Purpose of Financial Accounting

Understanding what is the primary purpose of financial accounting reveals why this discipline plays such a vital role in business operations and capital markets. The primary objective of financial accounting involves providing accurate, timely, and relevant financial information that enables stakeholders to make informed economic decisions.

Providing Information for External Decision-Making

The purpose of financial accounting is to give external stakeholders accurate, transparent, and reliable information that helps investors, creditors, and regulators evaluate your business and make informed decisions. Different stakeholder groups use financial accounting information for distinct purposes, each requiring reliable data to support their decisions.

Meeting the Needs of Different Stakeholders

Investors evaluate potential returns and overall financial health, creditors assess creditworthiness and repayment ability, regulators ensure compliance with reporting standards, and suppliers determine whether it's safe to extend credit or enter a contract. Each group relies on financial statements to answer specific questions about business performance and position. Lenders compare assets and liabilities to predict an organization's ability to repay loans, while investors analyze financial statements to estimate investment risks and predict future dividends. Suppliers and trade creditors need financial information to measure the short-term liquidity of an organization, and customers use statements to understand the long-run prospects of a business.

Ensuring Transparency and Accountability

What is the main purpose of financial accounting extends beyond simple information provision to include creating accountability and transparency. Public companies must publish financial statements that undergo independent audit, ensuring the information presented fairly represents their financial position and results. This verification provides confidence that stakeholders need when allocating capital and making business decisions. Financial accounting creates a system where companies must account publicly for their financial stewardship, reducing information asymmetry between insiders who manage businesses and outsiders who provide capital or engage in transactions with those businesses.

What Is Principles of Financial Accounting

Financial accounting operates according to established principles and standards that ensure consistency, comparability, and reliability. Understanding what is principles of financial accounting helps explain why financial statements maintain their usefulness across different companies and time periods.

Generally Accepted Accounting Principles (GAAP)

In the United States, Generally Accepted Accounting Principles (GAAP) are the standards for preparing financial statements that create consistency in how businesses report financial information so stakeholders can compare performance across companies. GAAP provides the authoritative framework that public companies must follow when preparing financial statements for external parties. These comprehensive standards address numerous aspects of financial reporting, from revenue recognition and expense matching to asset valuation and disclosure requirements. Following GAAP ensures that financial statements present information in standardized formats using consistent measurement approaches.

International Financial Reporting Standards (IFRS)

The International Financial Reporting Standards (IFRS) is a set of accounting standards stating how particular types of transactions and other events should be reported in financial statements, issued by the International Accounting Standards Board (IASB). Many countries outside the United States use IFRS as their primary accounting framework. While differences exist between GAAP and IFRS, both pursue the same fundamental objective: ensuring financial statements provide faithful, relevant representations of business performance and financial position that enable informed decision-making.

Core Accounting Principles and Concepts

Key principles guide financial accounting regardless of whether GAAP or IFRS standards apply. Revenue gets recognized when earned, not when cash arrives, while related expenses must be matched to the same reporting period for accurate performance measurement. Assets appear on balance sheets at their original cost rather than current market values, providing objective verification. Organizations must apply consistent accounting methods across years unless valid reasons justify changes, enabling stakeholders to compare results over time. For students working through complex accounting concepts and calculations, resources like Accounting Homework Help can provide step-by-step explanations that clarify challenging principles and their applications.

Key Financial Statements in Financial Accounting

Financial accounting produces several primary financial statements that collectively communicate a business's financial story to external stakeholders.

The Balance Sheet

The balance sheet is the financial statement showing a firm's assets, liabilities and equity (capital) at a set point in time, usually the end of the fiscal year reported on the accompanying income statement. This snapshot captures what a company owns, what it owes, and the residual ownership interest at a specific moment. The balance sheet demonstrates the fundamental accounting equation: Assets equal Liabilities plus Equity. Total assets always equal the total combined liabilities and equity, ensuring the statement remains in balance and providing a mathematical check on accuracy.

Understanding Assets, Liabilities, and Equity

Assets represent resources controlled by the company that are expected to provide future economic benefits. These include current assets like cash, accounts receivable, and inventory, as well as long-term assets like property, equipment, and intangible assets. Liabilities represent obligations to transfer economic resources to others, including accounts payable, loans, accrued expenses, and other debts. Equity represents the residual interest in assets after deducting liabilities—essentially the owners' claim on business resources.

The Income Statement

The statement of profit or income represents the changes in value of a company's accounts over a set period (most commonly one fiscal year), and may compare the changes to changes in the same accounts over the previous period. This performance report shows revenues earned, expenses incurred, and the resulting profit or loss. The income statement follows a structured format starting with revenues, subtracting cost of goods sold to arrive at gross profit, then deducting operating expenses to determine operating income, and finally accounting for non-operating items and taxes to calculate net income. All changes are summarized on the "bottom line" as net income, often reported as "net loss" when income is less than zero.

The Cash Flow Statement

The statement of cash flows considers the inputs and outputs in concrete cash within a stated period. This statement tracks how cash moves through the business, divided into three categories: operating activities, investing activities, and financing activities. The cash flow statement helps users understand liquidity—whether the company generates sufficient cash to meet obligations and fund operations. A company can show strong profits on the income statement yet struggle with cash flow if collections lag or capital expenditures are substantial.

The Statement of Stockholders' Equity

The statement of stockholders' equity shows changes in ownership interest during a period, including net income, dividends paid, stock issuances or repurchases, and other comprehensive income items. This statement connects the income statement to the balance sheet, explaining how earnings and other events affected ownership equity.

The Double-Entry Accounting System

The double-entry accounting system forms the foundation of modern financial accounting, requiring that every business transaction affects at least two accounts, with the total debits equaling the total credits. This fundamental system provides the framework for recording all financial transactions.

Understanding Debits and Credits

Debit entries account for increases in assets and expenses, while decreases in liabilities, equity, and income. Conversely, credit entries record decreases in assets and expenses, and increases in liabilities, equity, and income. This systematic approach minimizes errors and provides comprehensive views of business financial activities. The double-entry system ensures that the accounting equation remains in balance after every transaction. When one account is debited, at least one other account must be credited by an equal amount, creating a built-in error-checking mechanism.

Recording Transactions Through Journal Entries

Financial accountants record transactions initially in journals using journal entries that specify which accounts are debited and credited along with transaction amounts and explanations. These entries create the chronological record of all business financial activities. After recording in journals, transactions are posted to ledgers—accounts that accumulate all debits and credits for specific categories like cash, accounts receivable, or revenue. The general ledger contains all accounts used by a business, providing the source data for preparing financial statements.

Accrual Versus Cash Basis Accounting

The timing of transaction recognition represents a fundamental distinction in accounting methodologies. Financial accounting can follow either the accrual basis or the cash basis, though most businesses use accrual accounting for financial reporting.

Accrual Basis Accounting

Accrual accounting records revenue when it's earned and expenses when they're incurred, following the matching principle so income and related costs appear in the same reporting period. For example, if you complete a project in December but receive payment in January, accrual accounting records the revenue in December when earned. This method creates more accurate pictures of performance by including unpaid invoices and outstanding bills. However, it requires more detailed bookkeeping and necessitates close cash flow monitoring since revenue may be recorded before cash arrives.

Cash Basis Accounting

Cash basis accounting records revenues when cash is received and expenses when cash is paid, regardless of when the economic activity actually occurred. This simpler method tracks cash movements but doesn't match revenues with related expenses and can distort profitability measures. While some small businesses use cash basis accounting for simplicity, accrual accounting gives stakeholders a clearer view of long-term financial health, which is why financial accounting standards typically require accrual basis reporting for external financial statements.

The Financial Accounting Process

Financial accounting follows a systematic cycle that ensures all transactions are properly captured, recorded, and reported in financial statements.

Recording Transactions

The process begins with identifying and analyzing business transactions that have financial implications. Source documents like invoices, receipts, purchase orders, and contracts provide evidence of these transactions and serve as the basis for recording them in the accounting system.

Adjusting Entries

At period end, financial accountants prepare adjusting entries to ensure revenues and expenses are recorded in the correct period. These adjustments handle items like accrued revenues, accrued expenses, deferred revenues, and deferred expenses that span multiple accounting periods.

Preparing Financial Statements

After all transactions and adjustments are recorded, financial accountants prepare the primary financial statements—the balance sheet, income statement, cash flow statement, and statement of stockholders' equity. These statements include notes that provide additional detail and context necessary for proper interpretation.

Closing the Books

At fiscal year end, accountants close temporary accounts (revenues, expenses, and dividends) by transferring their balances to retained earnings. This process resets these accounts to zero for the new fiscal year while preserving the permanent accounts (assets, liabilities, and equity) that carry forward.

Careers in Financial Accounting

The financial accounting field offers diverse career opportunities for individuals with the right education, skills, and certifications.

Educational Requirements

Most financial accounting positions require at minimum a bachelor's degree in accounting, finance, or a related field. Accounting degree programs cover financial accounting, managerial accounting, auditing, taxation, and accounting information systems, providing foundational knowledge for entry into the profession.

Professional Certifications

The Certified Public Accountant (CPA) designation represents the premier credential in accounting. CPAs can perform audits of public company financial statements, represent clients before tax authorities, and access career opportunities unavailable to non-certified accountants. Other relevant certifications include the Chartered Financial Analyst (CFA) for those focusing on investment analysis, and the Certified Management Accountant (CMA) for those interested in both financial and managerial accounting.

Career Paths and Opportunities

Financial accountants work in public accounting firms providing audit, tax, and advisory services to clients across industries. Corporate financial accountants work in businesses preparing financial statements, managing accounting systems, and supporting financial reporting requirements. According to recent projections, the accounting profession offers strong employment prospects with competitive compensation. While technology automates routine tasks, the need for skilled professionals to analyze data, ensure compliance, and provide strategic insights continues to expand, offering excellent job security and advancement opportunities.

Conclusion

Understanding what is financial accounting reveals a systematic discipline that serves as the primary means of communicating business financial performance and position to external stakeholders. The financial accounting definition encompasses recording, summarizing, and reporting financial transactions according to established principles that ensure consistency, comparability, and reliability across organizations. What is the primary purpose of financial accounting centers on providing investors, creditors, regulators, and other external parties with accurate, timely information necessary for informed economic decision-making. Grounded in fundamental principles including revenue recognition, expense matching, consistency, and full disclosure, financial accounting produces standardized statements—the balance sheet, income statement, cash flow statement, and statement of stockholders' equity—that collectively tell a business's financial story. Whether following GAAP or IFRS, financial accounting maintains its essential role in capital markets and business operations by creating transparency and accountability that enables efficient resource allocation throughout the economy. For anyone pursuing business careers, investing in securities, or simply seeking to understand how organizations account for their financial activities, mastering financial accounting fundamentals provides essential knowledge that supports informed analysis and decision-making.

Frequently Asked Questions

What is the simple definition of financial accounting?

Financial accounting in simple words is the process of recording business financial transactions and preparing standardized reports called financial statements that show a company's financial performance and position to external parties. These statements—including the balance sheet, income statement, and cash flow statement—communicate whether the business is profitable, what it owns and owes, and how cash flows through operations. Financial accounting follows established rules to ensure information is consistent, reliable, and comparable across different companies and time periods.

What is the main difference between financial and managerial accounting?

The primary difference lies in their audiences and purposes. Financial accounting prepares standardized reports for external stakeholders like investors, creditors, and regulators, following strict rules such as GAAP or IFRS. These statements must be formatted consistently and often require independent audits. Managerial accounting provides customized information for internal management use to support planning, decision-making, and control, with no requirement to follow external standards. Managers can request reports in whatever format proves most useful for their specific needs.

What are the basic principles of financial accounting?

The fundamental principles include the revenue recognition principle, which determines when to record income; the matching principle, requiring expenses to be recorded in the same period as related revenues; the cost principle, recording assets at historical acquisition cost; the consistency principle, mandating use of the same accounting methods across periods; and the full disclosure principle, requiring transparent reporting of all significant information. Additionally, the going concern assumption presumes businesses will continue operating indefinitely, and the materiality principle focuses reporting on information significant enough to influence decisions.

Why is financial accounting important for businesses?

Financial accounting is important because it provides legal compliance with tax and securities regulations, creates transparency that builds stakeholder trust and confidence, enables access to capital by giving investors and lenders reliable information for decisions, facilitates performance evaluation by tracking profitability and financial position over time, and supports strategic planning by revealing trends and patterns in financial data. Without systematic financial accounting, businesses would struggle to attract investment, obtain credit, demonstrate accountability, or make informed decisions about resource allocation and business strategy.

What skills are needed for a career in financial accounting?

Financial accounting careers require strong technical accounting knowledge including understanding of GAAP or IFRS, double-entry bookkeeping, and financial statement preparation. Attention to detail is critical since small errors can have significant consequences. Analytical skills help interpret financial data and identify trends or anomalies. Proficiency with accounting software and spreadsheet applications is essential in modern practice. Strong communication skills enable explaining complex financial information to non-accountants. Ethical judgment and integrity are paramount given the trust society places in financial information. Finally, continuous learning ability is necessary since accounting standards, regulations, and technologies constantly evolve.