Table of contents

- What Is the Definition of Accounting

- What Is Basic Accounting: Core Components

- What Is the Purpose of Accounting

- What Is Accounting Principles: The Foundation of Practice

- Types of Accounting: Specialized Fields

- The Evolution of Accounting Through History

- Careers in Accounting: Opportunities and Requirements

- Conclusion

Accounting forms the foundation of every successful business, providing the systematic framework for tracking financial health and making informed decisions. Often called the language of business, accounting translates complex financial activities into understandable information that stakeholders use to evaluate performance and plan for the future. Whether you're a business owner, aspiring accountant, or simply curious about how financial information flows through organizations, understanding what is accounting represents an essential first step. The field of accounting extends far beyond simple number-crunching or bookkeeping. It encompasses a comprehensive system for recording, classifying, analyzing, and reporting financial information that serves diverse audiences including managers, investors, creditors, and regulatory authorities. This guide explores the accounting definition, fundamental principles, core purposes, and practical applications that make accounting indispensable in modern business and personal finance management.

What Is the Definition of Accounting

Accounting is the process of recording and processing information about economic entities, such as businesses and corporations. More specifically, accounting is the practice of recording financial transactions, maintaining accurate financial records, and preparing financial statements that help individuals and organizations understand their financial health.

The Comprehensive Accounting Definition

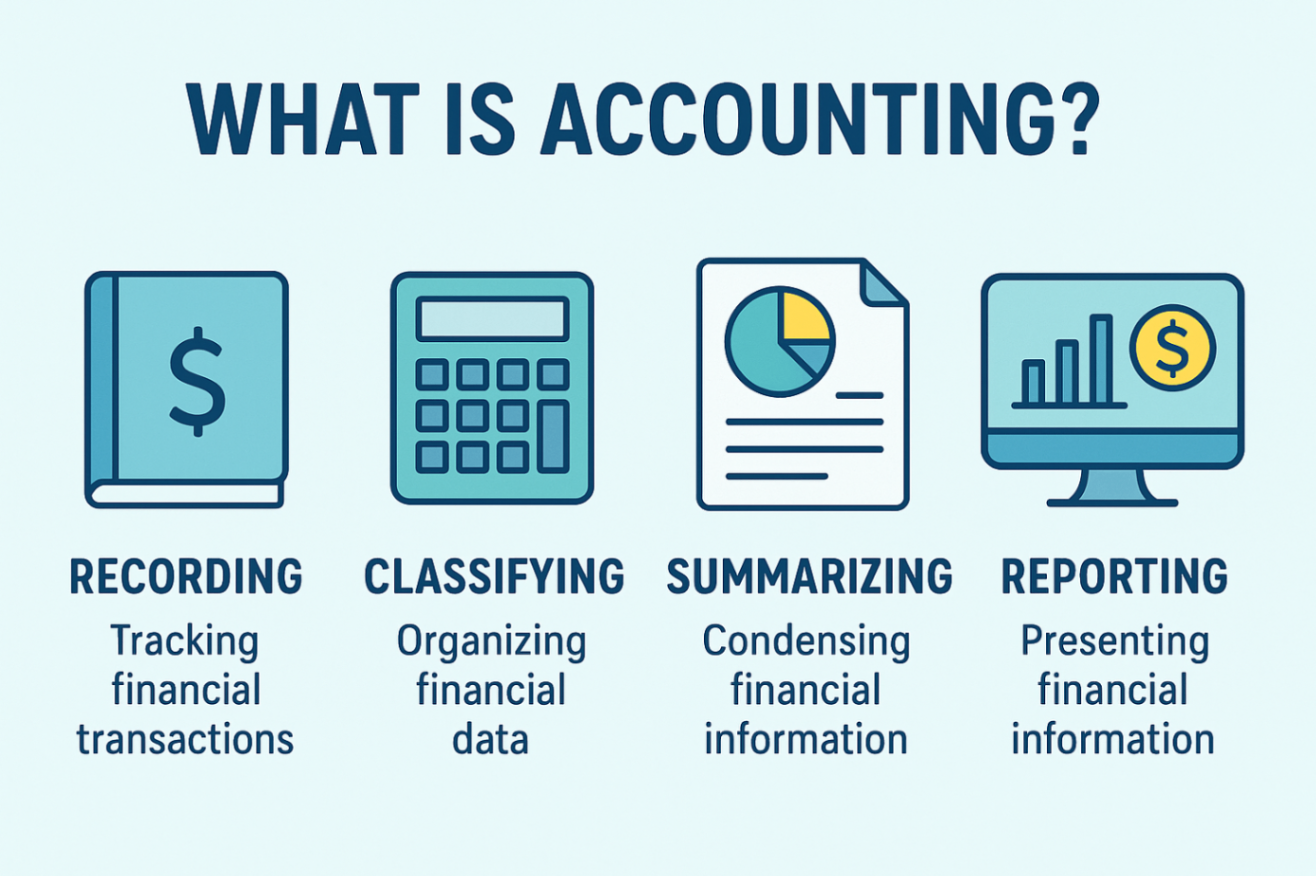

The American Institute of Certified Public Accountants (AICPA) provides a technical definition that captures accounting's essence: accounting represents the art of recording, classifying, and summarizing in significant manner and in terms of money, transactions and events which are of financial character, and interpreting the results thereof. This definition highlights several crucial elements that distinguish accounting from simple record-keeping. Accounting goes beyond simple bookkeeping, serving as a foundation for decision-making, regulatory compliance, and strategic planning. While bookkeeping focuses primarily on recording transactions, accounting involves analyzing that recorded data, interpreting financial results, and providing insights that guide business strategy and operations.

Accounting as Both Art and Science

Understanding what is accounting requires recognizing its dual nature. Accounting is considered an art because it requires the use of skills, creative judgment, and professional expertise developed through training and experience. Different accountants might approach the same situation with varying interpretations based on their professional judgment, especially in complex scenarios involving estimates or classifications. Simultaneously, accounting represents a science—a body of knowledge built on established principles, standards, and methodologies. However, accounting isn't an exact science since rules and principles constantly evolve as standard-setting bodies improve frameworks to address new business realities, technologies, and economic conditions.

The Language of Business

Accounting is famously known as the language of business because it provides the standardized vocabulary and grammar through which financial information is communicated. Just as language enables people to share ideas and thoughts, accounting enables businesses to convey their financial story to stakeholders who need to understand economic performance and position. This metaphor proves particularly apt because, like language, accounting requires learning specific terms, rules, and conventions before you can read, speak, or write it fluently. Financial statements serve as the primary documents through which this business language communicates essential information to diverse audiences.

What Is Basic Accounting: Core Components

Understanding what is basic accounting involves grasping the fundamental processes and components that form the accounting system's backbone. These elements work together to capture, organize, and report financial information systematically.

Recording Financial Transactions

Recording pertains to writing down or keeping records of business transactions as they occur. Every time a business receives money, pays expenses, purchases assets, or incurs liabilities, these activities must be documented in the accounting system. This documentation creates an audit trail showing exactly what happened, when it happened, and how it affected the business financially. The recording process typically begins with source documents—invoices, receipts, contracts, checks, and other papers that provide evidence of transactions. These documents support the entries made in accounting records and enable verification and auditing of financial information later. Modern accounting increasingly relies on technology for recording transactions. Accounting software streamlines data entry, automates repetitive tasks, and improves the accuracy of financial reporting. Tools like QuickBooks and other platforms help businesses capture transactions efficiently while maintaining the accuracy essential for reliable financial information.

Classifying and Organizing Financial Data

Classifying involves grouping similar items that have been recorded into meaningful categories. For example, all wage payments are classified together, all rent expenses are grouped, and all sales revenues are combined. This classification enables businesses to understand spending patterns, revenue sources, and financial trends that wouldn't be apparent from a simple chronological list of transactions. The chart of accounts provides the organizational framework for this classification. This master list contains all account categories a business uses—assets like cash and equipment, liabilities such as loans and accounts payable, equity accounts, revenue sources, and expense categories. Every transaction recorded gets classified into appropriate accounts from this chart. Proper classification ensures financial statements present information logically and consistently across reporting periods. When transactions are classified correctly, financial reports become useful tools for analysis rather than confusing compilations of numbers.

Summarizing and Reporting Results

Once classified, information is summarized into reports called financial statements that communicate a business's financial story. The three primary financial statements include the income statement showing revenues and expenses over a period, the balance sheet presenting assets, liabilities, and equity at a specific point in time, and the cash flow statement detailing how cash moves through the business. These financial statements represent the end product of the accounting process—the documents that stakeholders actually read and analyze. They transform thousands or millions of individual transactions into digestible summaries that reveal profitability, financial position, liquidity, and other critical business metrics. For students and professionals working through complex accounting concepts, tools like the Accounting AI Solver can provide step-by-step explanations that clarify challenging topics and calculations.

What Is the Purpose of Accounting

Understanding the purpose of accounting reveals why this discipline plays such a vital role in business operations and economic decision-making. The purpose of accounting is to accumulate and report on financial information about the performance, financial position, and cash flows of a business.

Providing Information for Decision-Making

The primary purpose of accounting is to provide stakeholders, inclusive of management, investors, creditors, and regulatory bodies, with applicable and reliable data about the financial performance and function of an entity. This information proves essential for various decisions across different stakeholder groups. Business managers use accounting information to decide whether to launch new products, expand operations, reduce costs, or adjust pricing strategies. Investors rely on financial reports to determine whether to buy, hold, or sell stock in a company. Creditors examine accounting data when deciding whether to extend loans and at what interest rates. Regulatory authorities use accounting information to ensure compliance with laws and regulations. The ultimate purpose of accounting centers on providing information that enables rational decision-making. When presented with multiple courses of action, stakeholders need financial data to evaluate alternatives and select the option most likely to achieve desired outcomes.

Measuring Financial Performance

One crucial purpose of accounting involves measuring how well a business performs financially over specific periods. Through the income statement, accounting reveals whether operations generated profits or losses, how revenues compare to expenses, and which business activities contribute most to financial success. Performance measurement extends beyond simple profit calculation. Accounting enables detailed analysis of margins, return on investment, efficiency ratios, and other metrics that reveal whether the business is improving, declining, or maintaining steady performance. These measurements guide strategic planning and operational adjustments. Without systematic accounting, businesses would lack objective ways to evaluate whether their strategies work, whether they're making money, and how current performance compares to past results or competitors' achievements.

Ensuring Legal Compliance and Accountability

Accounting serves essential regulatory and legal purposes. Governments require businesses to maintain accurate financial records for tax reporting. Whether it's financial reporting for shareholders or tax accounting for government compliance, the accounting process ensures clarity and accountability in the flow of money. Public companies face additional regulatory requirements including audited financial statements that meet specific standards. These requirements protect investors by ensuring they receive accurate, complete information about companies they invest in. Accounting provides the framework for meeting these legal obligations while maintaining transparency and accountability. Beyond external regulations, accounting creates internal accountability by tracking who authorized expenditures, received payments, or approved transactions. This audit trail deters fraud and enables investigation when financial irregularities arise.

Facilitating Financial Planning and Control

Accounting information forms the foundation for budgeting, forecasting, and long-term financial planning. Historical financial data reveals trends and patterns that inform projections about future performance. Businesses use accounting information to set realistic budgets, allocate resources strategically, and plan for capital investments. The control function of accounting involves comparing actual results against budgets and plans, identifying variances, and taking corrective action when performance deviates from expectations. This continuous monitoring helps businesses stay on track toward financial goals and respond quickly when problems emerge.

What Is Accounting Principles: The Foundation of Practice

Accounting principles represent the fundamental rules, concepts, and guidelines that govern how financial information should be recorded, measured, and reported. Understanding what is accounting principles help explain why accounting practices maintain consistency and reliability across organizations.

Generally Accepted Accounting Principles (GAAP)

In the United States, the Financial Accounting Standards Board maintains the financial accounting and reporting standards for US-based companies, known as Generally Accepted Accounting Principles. GAAP provides the authoritative framework that public companies must follow when preparing financial statements. GAAP encompasses numerous standards, interpretations, and guidelines covering topics from revenue recognition to asset valuation. These principles ensure that companies prepare financial statements consistently, making it possible to compare financial information across different businesses and time periods. While private companies have some flexibility, following GAAP demonstrates credibility and facilitates transactions with banks, investors, and business partners who expect financial statements prepared according to recognized standards.

International Financial Reporting Standards (IFRS)

IFRS is a set of accounting rules developed by the International Accounting Standards Board for worldwide public companies. As of 2025, IFRS has been adopted in numerous jurisdictions globally, providing an international standard that companies use to conduct business across borders. The primary difference between GAAP and IFRS lies in approach—GAAP tends toward rules-based standards with detailed guidance for specific situations, while IFRS follows principles-based standards emphasizing professional judgment. Despite differences, both frameworks pursue the same goal: ensuring financial statements present faithful, relevant information about business performance and position.

Core Accounting Principles and Concepts

Several fundamental principles underpin all accounting practice regardless of specific standards. The revenue recognition principle establishes when revenue should be recorded—generally when earned rather than when cash is received. The matching principle requires expenses to be recorded in the same period as the related revenues, providing accurate profit measurement. The cost principle requires assets to be recorded at their original purchase cost rather than current market value. The consistency principle mandates that once a business selects an accounting method, it should continue using that method in future periods unless a compelling reason exists to change. The full disclosure principle requires companies to report all significant information in financial statements and accompanying notes. These principles, among others, create the framework ensuring accounting information remains objective, verifiable, and useful for decision-making purposes.

Types of Accounting: Specialized Fields

The broad field of accounting encompasses several specialized areas, each serving distinct purposes and audiences. Understanding these different types reveals the diversity within the accounting profession.

Financial Accounting

Financial accounting focuses on preparing financial statements for external users including investors, creditors, regulators, and the general public. This branch emphasizes compliance with accounting standards like GAAP or IFRS and produces the income statement, balance sheet, cash flow statement, and statement of stockholders' equity. Public companies must have their financial statements audited by independent certified public accountants who verify that statements present the company's financial position and results. This external validation provides credibility that stakeholders need when making investment and lending decisions. Financial accounting follows strict rules about what must be reported, how items should be measured, and what disclosures must accompany statements. This standardization enables users to compare financial information across companies and industries.

Managerial Accounting

While financial accounting serves external audiences, managerial accounting provides information for internal management use. This branch focuses on data that helps managers plan operations, make decisions, and control business activities. For a deeper exploration of this field, read our comprehensive guide on what is managerial accounting. Managerial accounting isn't bound by GAAP or other external standards—managers can request reports in whatever format proves most useful for their purposes. This flexibility allows managerial accounting to provide detailed cost analyses, profitability reports by product or department, and forward-looking budgets and forecasts. Examples of managerial accounting reports include cost-volume-profit analysis, variance analysis comparing actual results to budgets, and make-or-buy decisions evaluating whether to produce components internally or purchase from suppliers.

Tax Accounting

Tax accounting specializes in preparing tax returns, planning tax strategy, and ensuring compliance with tax laws and regulations. Tax accountants must understand complex tax codes that differ from financial accounting standards, meaning taxable income often differs from accounting income reported in financial statements. This specialization involves analyzing transactions through a tax lens, identifying deductions and credits that minimize tax liability, and advising clients on tax-efficient business structures and transactions. Tax accountants work with individuals, businesses, estates, and other entities subject to taxation. Given constantly changing tax laws and the complexity of tax codes, tax accounting represents a highly specialized field requiring continuous education and detailed knowledge of current regulations.

Cost Accounting

Cost accounting focuses on capturing and analyzing costs associated with producing goods or services. This specialization helps businesses understand product costs, set prices, control expenses, and improve profitability. Cost accountants track direct costs like materials and labor that can be traced specifically to products, as well as indirect costs like utilities and rent that must be allocated across multiple products. They use various methods including job costing, process costing, and activity-based costing depending on the business type and information needs. This detailed cost information enables managers to identify inefficiencies, eliminate waste, optimize production processes, and make informed pricing decisions that ensure profitability while remaining competitive.

Auditing

Auditing involves examining financial records, accounting systems, and internal controls to verify accuracy and compliance. External auditors provide independent verification of financial statements, while internal auditors focus on evaluating company operations, identifying risks, and recommending improvements. Auditors must maintain independence and objectivity, following established auditing standards when conducting examinations. The audit process includes testing transactions, examining supporting documentation, evaluating internal controls, and issuing reports on findings. Auditing provides assurance to stakeholders that financial information is reliable and that companies maintain adequate controls over financial reporting processes.

The Evolution of Accounting Through History

Understanding accounting's historical development provides context for current practices and reveals how this field continuously adapts to changing business needs and technologies.

Ancient Origins

The roots of accounting trace back thousands of years, with some of the earliest evidence found in Mesopotamia, where merchants used clay tablets to document business transactions. Ancient civilizations recognized the need to track resources, tax collections, and commercial activities, developing rudimentary accounting systems that served their purposes. Ancient Egyptians, Greeks, and Romans all maintained financial records to manage government finances, track agricultural production, and facilitate trade. While primitive by modern standards, these early systems established the foundation for systematic financial record-keeping.

The Birth of Double-Entry Bookkeeping

The introduction of double-entry bookkeeping during the Renaissance marked a significant evolution in the field, credited to Luca Pacioli. This Italian mathematician and Franciscan friar published the first comprehensive description of double-entry accounting in 1494, establishing basic accounting principles still in use today. Double-entry bookkeeping revolutionized accounting by recognizing that every transaction affects at least two accounts—one debited and one credited—ensuring the accounting equation remains balanced. This system provides built-in error checking and produces more complete financial information than single-entry methods. The double-entry system spread throughout Europe as commerce expanded, becoming the standard approach for maintaining business financial records and remaining the foundation of modern accounting practice.

Modern Accounting Development

As commerce expanded, so did the need for more structured financial reporting, with the development of generally accepted accounting principles and the rise of professional organizations helping standardize accounting functions across sectors. The formation of professional accounting bodies like the American Institute of Certified Public Accountants (AICPA) in the United States established standards for accounting education, ethics, and practice. Similar organizations emerged worldwide, creating the accounting profession's infrastructure. The 20th century saw rapid accounting evolution driven by regulatory requirements following financial crises, the growth of public companies needing investor information, and increasing business complexity. Standard-setting bodies emerged to create authoritative guidance, while regulations like securities laws mandated specific reporting requirements.

Technology's Impact on Accounting

Modern accounting practice is heavily influenced by technology that has transformed how financial information is captured, processed, and reported. Early computerization automated calculations and record-keeping, dramatically improving efficiency and accuracy. Today's cloud-based accounting systems enable real-time financial reporting, automated transaction recording through bank feeds, and sophisticated analytics that provide insights previously impossible to obtain. Artificial intelligence and machine learning are beginning to automate routine tasks, allowing accountants to focus on analysis, judgment, and advisory services. Despite technological advances, fundamental accounting principles remain constant. Technology changes how accounting is performed but not the underlying purpose of providing reliable financial information for decision-making.

Careers in Accounting: Opportunities and Requirements

The accounting field offers diverse career paths with strong employment prospects and competitive compensation. Understanding career options helps those considering accounting as a profession.

Educational Requirements

Most accounting positions require at minimum a bachelor's degree in accounting or a related field. Accounting degrees are designed to offer foundational knowledge in areas such as financial accounting, managerial accounting, auditing, and taxation. Coursework typically covers financial statement preparation, cost accounting, tax principles, auditing standards, accounting information systems, and business law. Many programs also incorporate ethics training given the trust society places in accountants to provide honest, accurate financial information. Advanced positions and certain specializations may require master's degrees in accounting, taxation, or business administration. Graduate education provides deeper expertise in specialized areas and prepares students for leadership roles in accounting organizations.

Professional Certifications

The Certified Public Accountant (CPA) designation represents the most recognized accounting credential. Obtaining a CPA license requires completing specific education requirements, passing a comprehensive exam, gaining professional experience, and maintaining continuing education. CPAs can perform audits of public companies, represent clients before the IRS, and access career opportunities unavailable to non-certified accountants. Many employers prefer or require CPA certification for senior accounting positions. Other certifications serve specific specializations: the Certified Management Accountant (CMA) for managerial accounting, Certified Internal Auditor (CIA) for internal auditing, and Certified Fraud Examiner (CFE) for forensic accounting. These credentials demonstrate expertise and commitment to professional standards.

Career Paths and Opportunities

Accountants work in diverse settings including public accounting firms, corporations, government agencies, and nonprofit organizations. Public accounting offers exposure to multiple clients and industries, providing excellent training and career development. Corporate accounting positions include roles like staff accountant, financial analyst, controller, and chief financial officer. These positions involve preparing financial reports, managing accounting systems, overseeing budgets, and providing financial guidance to organizational leadership. Government accounting focuses on public sector financial management, compliance with governmental accounting standards, and auditing of government programs. Nonprofit accounting involves unique challenges related to fund accounting, grant compliance, and donor reporting. The Bureau of Labor Statistics projects continued demand for accountants, with opportunities expanding as businesses face increasingly complex financial regulations and global operations. According to recent rankings, accounting is considered one of the best business professions, offering strong salary potential and career stability.

Conclusion

Understanding what accounting reveals is why this discipline serves as the backbone of business operations and financial decision-making. The accounting definition encompasses far more than number-crunching—it represents a comprehensive system for recording, classifying, analyzing, and reporting financial information that stakeholders need to make informed decisions. The purpose of accounting extends from measuring financial performance and ensuring legal compliance to facilitating planning and maintaining accountability throughout organizations. Grounded in fundamental accounting principles like GAAP and IFRS, the field includes specialized areas from financial and managerial accounting to tax, cost, and audit functions. From ancient origins to modern technology-driven practice, accounting has continuously evolved while maintaining its essential role as the language of business. Whether you're considering an accounting career, running a business, or simply seeking to understand financial statements better, grasping what is basic accounting provides the foundation for financial literacy and sound economic decision-making in our complex business world.

Frequently Asked Questions

What is the simple definition of accounting?

In simple terms, accounting is the systematic process of recording, organizing, and reporting financial information about a business or individual. It tracks where money comes from, where it goes, and what financial resources remain at any given time. Think of accounting as the system that keeps score of financial activities, transforming raw transaction data into understandable reports that show whether a business is making or losing money, what it owns, and what it owes.

What is the main purpose of accounting in business?

The main purpose of accounting is to provide accurate, timely financial information that helps stakeholders make informed economic decisions. For business owners and managers, accounting shows profitability, identifies cost problems, and guides strategic planning. For investors, it reveals whether companies represent sound investments. For creditors, it demonstrates the ability to repay loans. Accounting also ensures legal compliance with tax laws and financial regulations while creating accountability and transparency in how organizations manage financial resources.

What are the basic accounting principles everyone should know?

The fundamental accounting principles include the revenue recognition principle, which determines when to record income; the matching principle, requiring expenses to be recorded in the same period as related revenues; the cost principle, which records assets at purchase price rather than current value; the consistency principle, mandating use of the same accounting methods across periods; and the full disclosure principle, requiring transparent reporting of all significant information. These principles ensure financial statements remain objective, comparable, and useful for decision-making.

How is accounting different from bookkeeping?

Bookkeeping focuses primarily on the recording of financial transactions—documenting sales, purchases, receipts, and payments in the accounting system. It's the foundational data entry component of financial management. Accounting encompasses bookkeeping but extends far beyond it to include analyzing recorded transactions, interpreting financial results, preparing reports, providing strategic insights, and making recommendations. While bookkeepers maintain financial records, accountants use those records to evaluate performance, guide decisions, and communicate financial information to stakeholders.

Do I need to study accounting if I want to start a business?

While you don't need formal accounting education to start a business, understanding basic accounting principles proves extremely valuable for entrepreneurial success. Business owners who grasp fundamental concepts like profitability, cash flow, and financial statements make better decisions about pricing, expenses, and growth strategies. You can hire accountants to handle complex tasks, but knowing enough accounting to read financial reports, understand what numbers mean, and ask intelligent questions about your business finances significantly improves your chances of building a successful, sustainable enterprise.