Table of contents

- What Is the Accounting Equation and Why Does It Matter?

- What Is the Accounting Equation Formula?

- Components of the Accounting Equation Explained

- What Is the Expanded Accounting Equation?

- What Is the Purpose of the Accounting Equation?

- What Is the Role of the Accounting Equation in the Analysis of Business Transactions?

- Practical Application: The Accounting Equation in Action

- The Accounting Equation and Financial Statements

- Conclusion

If you're studying accounting or running a business, understanding what is the accounting equation is absolutely essential. This fundamental principle serves as the cornerstone of financial reporting and ensures that every business transaction is accurately recorded. The accounting equation provides a mathematical framework that keeps financial statements balanced and reveals the true financial position of any organization, from small startups to multinational corporations.

What Is the Accounting Equation and Why Does It Matter?

The accounting equation is a fundamental principle stating that a company's total assets must always equal the sum of its liabilities and equity. This relationship forms the basis of double-entry bookkeeping and ensures that financial records remain accurate and balanced at all times. When people ask what is the basic accounting equation, they're referring to this core formula that every accountant, business owner, and financial professional must understand. The equation demonstrates that everything a company owns (assets) has been financed either through borrowing money (liabilities) or through owner investments and retained earnings (equity). This mathematical relationship isn't just an academic concept—it's the practical foundation that ensures every dollar in your business is accounted for properly. Whether you're preparing financial statements, analyzing business performance, or making strategic decisions, the accounting equation guides your understanding of how resources flow through your organization.

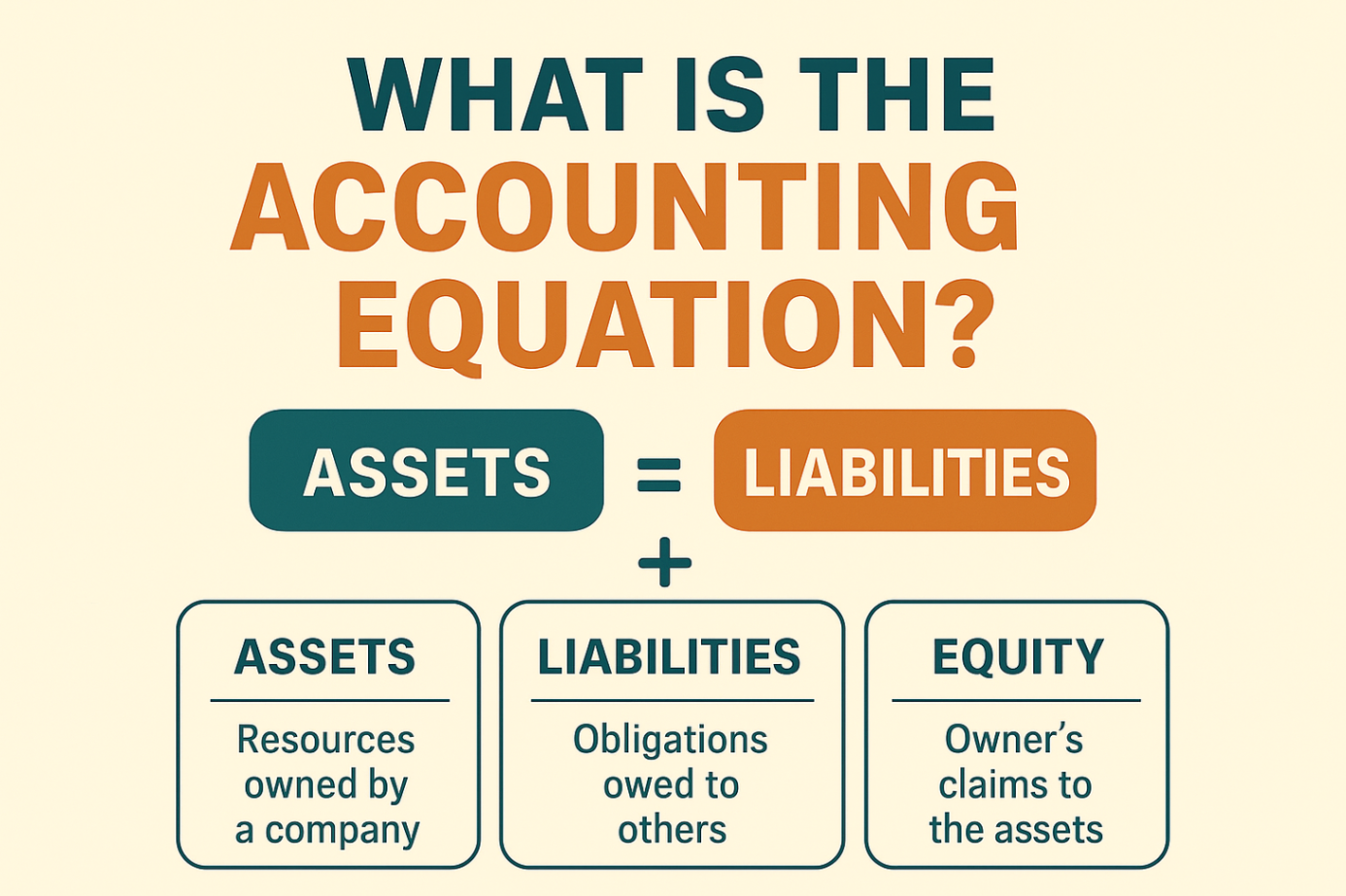

What Is the Accounting Equation Formula?

What is the fundamental accounting equation? The most common way to express this relationship is: Assets = Liabilities + Equity This formula can be rearranged in different ways depending on what you're trying to calculate:

Equity = Assets – Liabilities (calculating owner's equity) Liabilities = Assets – Equity (determining total debt)

Each version of what is the fundamental equation of accounting provides the same information from a different perspective. The formula you choose depends on what financial question you're trying to answer. Regardless of how you arrange it, the equation must always balance—this is a non-negotiable rule in accounting.

Components of the Accounting Equation Explained

To fully grasp what is the accounting equation used for, you need to understand its three core components and how they interact within your business's financial ecosystem.

Assets: What Your Business Owns

Assets represent everything of value that your company owns or controls. These resources have economic value and can potentially be converted into cash or provide future benefits. Assets fall into two main categories: current assets (easily converted to cash within a year) and non-current assets (long-term holdings). Common examples include cash, accounts receivable, inventory, equipment, buildings, vehicles, patents, and investments. When evaluating your business's financial health, assets represent your company's economic resources and potential for generating revenue.

Liabilities: What Your Business Owes

Liabilities are financial obligations your company must fulfill—essentially, what you owe to others. These represent debts and future payments that will require an outflow of resources. Understanding liabilities is crucial because they impact your company's financial flexibility and risk profile. Examples include accounts payable, loans, mortgages, accrued expenses, deferred revenue, and bonds payable. Managing liabilities effectively ensures your business maintains good credit standing and can meet its financial obligations without jeopardizing operations.

Equity: Owner's Stake in the Business

Equity represents the owner's residual interest in the business after deducting all liabilities from assets. Think of it as what would be left over if you sold everything the company owns and paid off all debts. For corporations, this is called shareholders' equity; for sole proprietorships, it's simply called owner's equity. Equity includes owner contributions, retained earnings (accumulated profits kept in the business), and additional paid-in capital. A growing equity balance typically indicates a healthy, profitable business, while decreasing equity might signal financial difficulties.

What Is the Expanded Accounting Equation?

While the basic formula provides a snapshot of financial position, what is the accounting equation expanded to include? The expanded version incorporates revenue, expenses, and owner withdrawals to show how business operations affect equity over time: Assets = Liabilities + Owner's Capital + Revenue – Expenses – Drawings This expanded formula shows what is the role of the accounting equation in analyzing business transactions by revealing how daily operations impact overall financial position. Revenue increases equity, while expenses and owner withdrawals decrease it. This version provides a more dynamic view of how business activities change the fundamental equation throughout an accounting period.

What Is the Purpose of the Accounting Equation?

Understanding what is the purpose of the accounting equation reveals why it's so critical to financial management. The equation serves multiple essential functions that keep businesses financially sound and transparent. First, it ensures accuracy in financial reporting by requiring that books always balance. If your assets don't equal liabilities plus equity, you know immediately that an error exists somewhere in your records. This built-in error detection mechanism is invaluable for maintaining accurate financial data. Second, the equation provides a framework for the double-entry bookkeeping system, where every transaction affects at least two accounts. This systematic approach prevents errors and ensures complete transaction recording. When you purchase equipment with cash, assets remain balanced because one asset (equipment) increases while another (cash) decreases by the same amount. Third, it offers instant insight into financial health and solvency. By examining the relationship between assets, liabilities, and equity, stakeholders can quickly assess whether a company has sufficient resources to meet its obligations.

What Is the Role of the Accounting Equation in the Analysis of Business Transactions?

What is the role of the accounting equation in analyzing business transactions? Every single business transaction impacts the accounting equation in a measurable way. Understanding these impacts helps you make informed decisions and maintain accurate records. When you take out a business loan, liabilities increase, but so do assets (cash received). When you purchase inventory on credit, both assets (inventory) and liabilities (accounts payable) increase. When you earn revenue, assets increase and equity increases. Each transaction maintains the equation's balance while changing your financial position. This relationship helps accountants verify that transactions are recorded correctly. If a transaction doesn't maintain the equation's balance, it indicates an error in recording. Financial professionals use this principle constantly to check their work and ensure financial statement accuracy. For business owners, understanding how transactions affect the equation enables better decision-making. You can see immediately how purchasing equipment, taking on debt, or retaining earnings will impact your overall financial position. If you need assistance with complex accounting concepts and calculations, resources like Accounting Homework Help can provide valuable support for understanding these principles.

Practical Application: The Accounting Equation in Action

Let's examine how the accounting equation works through a simple example. Imagine you start a business with a $10,000 investment. Initially, you have $10,000 in assets (cash) and $10,000 in equity (owner's capital). The equation balances: $10,000 = $0 + $10,000. Next, you take out a $5,000 loan. Now assets increase to $15,000 (cash increases), and liabilities are $5,000 (the loan), while equity remains $10,000. The equation still balances: $15,000 = $5,000 + $10,000. You then purchase equipment for $8,000 cash. Assets remain at $15,000 (cash decreases by $8,000, equipment increases by $8,000), liabilities stay at $5,000, and equity stays at $10,000. Even though the composition of assets changed, the equation maintains its balance. Understanding these mechanics connects to broader accounting concepts, including intangible assets like what is goodwill in accounting , which also must be properly recorded within the accounting equation framework.

The Accounting Equation and Financial Statements

The accounting equation directly corresponds to the balance sheet, one of the three primary financial statements. The balance sheet presents a company's financial position at a specific moment in time, organized exactly according to the accounting equation structure. On a balance sheet, you'll see assets listed on one side and liabilities plus equity on the other. These two sides must always equal each other, reflecting the fundamental equation. This is why it's called a "balance" sheet—it must balance according to the accounting equation. The income statement also relates to the equation because net income (revenue minus expenses) flows into equity through retained earnings. This connection between financial statements demonstrates how the accounting equation underpins all financial reporting.

Conclusion

The accounting equation represents the foundational principle of financial accounting, ensuring that every business transaction is accurately recorded and that financial statements remain balanced. Understanding what is the accounting equation, its formula, components, and purpose equips you with essential knowledge for financial management, whether you're an accounting student, small business owner, or financial professional. By recognizing how assets, liabilities, and equity interact through this mathematical relationship, you gain powerful insights into business financial health and can make more informed decisions. The equation's elegance lies in its simplicity—three components that, when properly balanced, tell the complete story of a company's financial position and provide the framework for all modern accounting practices.

Frequently Asked Questions

1. What is the definition of accounting equation?

The accounting equation is a fundamental accounting principle that states a company's total assets must always equal the sum of its total liabilities plus total equity (Assets = Liabilities + Equity). This equation forms the foundation of double-entry bookkeeping and ensures that financial statements remain balanced, providing an accurate snapshot of a company's financial position at any given time.

2. What is the difference between the basic and expanded accounting equation?

The basic accounting equation is Assets = Liabilities + Equity, which shows the fundamental relationship between what a company owns and how it's financed. The expanded accounting equation breaks down equity further to include: Assets = Liabilities + Owner's Capital + Revenue – Expenses – Drawings. This expanded version shows how daily business operations—earning revenue, incurring expenses, and making withdrawals—affect the overall equation.

3. How does the accounting equation relate to the balance sheet?

The accounting equation is the structural foundation of the balance sheet. The balance sheet is literally a visual representation of the accounting equation, with assets presented on one side and liabilities plus equity on the other. These two sides must always equal each other, which is why it's called a "balance" sheet. Every item on a balance sheet fits into one of the three components of the accounting equation.

4. Why must the accounting equation always balance?

The accounting equation must always balance because of the double-entry bookkeeping system, where every transaction affects at least two accounts with equal and opposite entries. If the equation doesn't balance, it indicates an error in recording transactions. This built-in error detection mechanism ensures accuracy in financial reporting and helps accountants identify mistakes immediately.

5. Can the accounting equation be used for personal finances?

Yes, the accounting equation can be applied to personal finances to understand your financial position. Your personal assets (what you own, like cash, investments, and property) minus your liabilities (what you owe, like mortgages and credit card debt) equals your net worth (your equity). This same fundamental principle helps individuals track their financial health just as businesses do.