Table of contents

- What Is the Double Entry Accounting System?

- The Foundation: Understanding the Accounting Equation

- The Five Account Types in Double Entry Accounting

- How Debits and Credits Work

- Double Entry Accounting Examples in Practice

- Single Entry vs Double Entry Accounting

- Benefits of the Double Entry Accounting System

- Limitations to Consider

- Conclusion

Understanding what is double entry accounting is essential for anyone involved in business finance, bookkeeping, or accounting. This fundamental bookkeeping method forms the backbone of modern financial reporting and ensures that every transaction in your business is accurately recorded and easily traceable. Whether you're a small business owner, accounting student, or finance professional, mastering double entry accounting will transform how you understand and manage financial data.

What Is the Double Entry Accounting System?

What is double entry accounting? It's a bookkeeping method where every financial transaction is recorded in at least two accounts simultaneously—as both a debit and a credit. This dual recording system ensures that your books always balance and provides a complete picture of money flowing in and out of your business. The core principle behind what is a double entry accounting system is that every transaction has two equal and opposite effects. When cash leaves your business, it must go somewhere. When you acquire an asset, something must fund that purchase. Double entry accounting captures both sides of this financial equation, creating a self-checking mechanism that catches errors and prevents fraud. This system differs fundamentally from single-entry accounting, where transactions are recorded only once. While single-entry might work for a personal checkbook, businesses need the comprehensive tracking that only double entry provides. The method complies with Generally Accepted Accounting Principles (GAAP) and is required for most business entities, making it the standard for professional financial reporting.

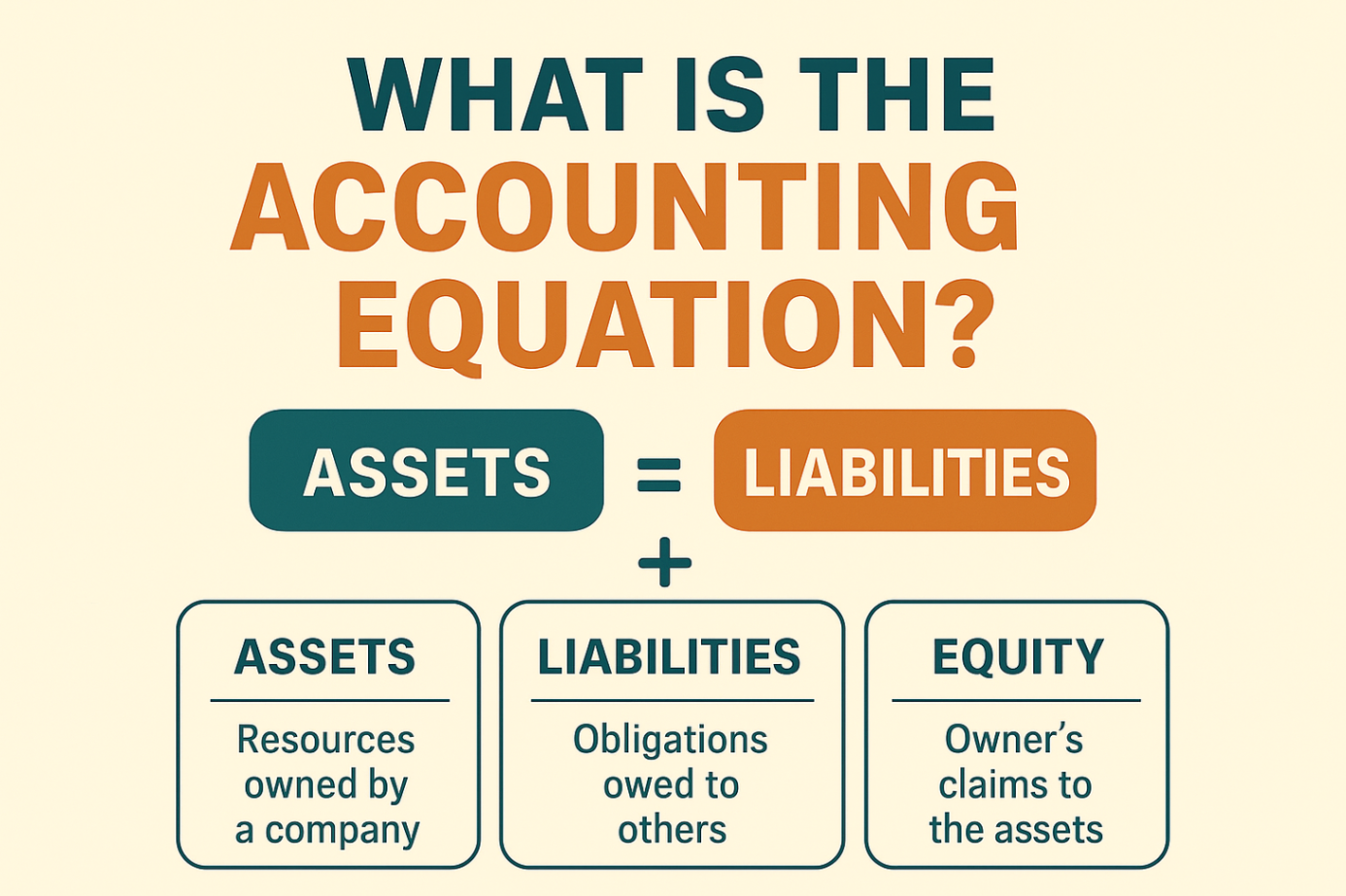

The Foundation: Understanding the Accounting Equation

What is double entry system of accounting built upon? The entire system rests on the fundamental accounting equation: Assets = Liabilities + Equity This equation must always remain balanced. If your company has $50,000 in assets and $30,000 in liabilities, then equity must equal $20,000. Any imbalance signals an error that needs correction. Understanding what is the accounting equation is crucial because double entry accounting is essentially a practical application of this mathematical relationship. Every transaction you record affects at least two accounts while maintaining this balance. When you purchase equipment with cash, your total assets remain the same—cash decreases while equipment increases. When you take out a loan, both assets (cash) and liabilities (loan payable) increase by the same amount. The equation always balances because double entry captures both sides of every transaction.

The Five Account Types in Double Entry Accounting

To fully understand what is double entry bookkeeping in accounting, you need to know the five main account categories that organize all financial transactions.

Asset Accounts

Asset accounts represent everything your business owns that has economic value. This includes cash, accounts receivable, inventory, equipment, buildings, and investments. Assets can be converted to cash or provide future benefits to your business. In double entry accounting, assets typically increase with debits and decrease with credits.

Liability Accounts

Liability accounts track what your business owes to others. These include loans, accounts payable, mortgages, accrued expenses, and deferred revenue. Liabilities represent obligations that will require future payment or service. In double entry accounting, liabilities increase with credits and decrease with debits.

Equity Accounts

Equity accounts show the owner's stake in the business after subtracting liabilities from assets. This includes owner contributions, retained earnings, and common stock for corporations. Equity represents the residual interest in your company and increases with credits while decreasing with debits.

Revenue Accounts

Revenue accounts track income your business earns through its operations, such as sales revenue, service fees, and interest income. Revenue increases equity and is recorded as a credit. When you earn money, revenue accounts are credited.

Expense Accounts

Expense accounts capture the costs of running your business, including rent, utilities, wages, supplies, and marketing. Expenses decrease equity and are recorded as debits. When you spend money on business operations, expense accounts are debited.

How Debits and Credits Work

The debit and credit system is central to understanding what is the double entry accounting system and how transactions flow through your books. Every transaction requires at least one debit entry and one credit entry that must equal each other. Debits are recorded on the left side of the accounting ledger and serve different functions depending on account type. Debits increase asset and expense accounts while decreasing liability, equity, and revenue accounts. For example, when you pay rent, you debit (increase) your rent expense account. Credits are recorded on the right side of the ledger with opposite effects. Credits increase liability, equity, and revenue accounts while decreasing asset and expense accounts. When a customer pays you, you credit (decrease) accounts receivable while debiting (increasing) cash. This might seem complex initially, but the logic becomes intuitive with practice. The key is remembering that total debits must always equal total credits for every transaction. This equality is what keeps your books balanced and your accounting equation intact.

Double Entry Accounting Examples in Practice

Let's examine how double entry accounting works through practical examples that demonstrate the debit and credit relationship.

Example 1: Purchasing Inventory on Credit

Your business purchases $5,000 worth of inventory on credit from a supplier. Two accounts are affected: Inventory (asset) increases by $5,000, and Accounts Payable (liability) increases by $5,000. The journal entry would be: Debit Inventory $5,000 and Credit Accounts Payable $5,000. Total debits equal total credits, and the accounting equation remains balanced—assets increased, but so did liabilities.

Example 2: Receiving Customer Payment

A customer pays $2,000 for services you provided on credit. Two accounts change: Cash (asset) increases by $2,000, and Accounts Receivable (asset) decreases by $2,000. The journal entry would be: Debit Cash $2,000 and Credit Accounts Receivable $2,000. Notice that while both accounts are assets, one increases while the other decreases, keeping total assets unchanged.

Example 3: Taking Out a Business Loan

Your business receives a $10,000 bank loan. Cash (asset) increases by $10,000, and Loan Payable (liability) increases by $10,000. The journal entry would be: Debit Cash $10,000 and Credit Loan Payable $10,000. The equation stays balanced because both assets and liabilities increased by equal amounts.

Single Entry vs Double Entry Accounting

Understanding the contrast between these methods clarifies why double entry accounting is superior for most businesses. Single entry accounting records each transaction only once, similar to maintaining a personal checkbook. You simply track money coming in and going out without distinguishing between asset types or liability sources. While simpler, this method provides limited financial insight and makes error detection difficult. Double entry accounting records each transaction twice, providing a complete audit trail and automatic error checking. If your books don't balance, you immediately know something is wrong. This method enables creation of comprehensive financial statements and provides the detailed analysis businesses need for informed decision-making. Single entry might suit very small operations with simple finances, but any business seeking loans, investors, or growth needs the robust framework of double entry accounting. If you're struggling with these concepts, resources like Accounting Assignment Help can provide valuable support for mastering this essential system.

Benefits of the Double Entry Accounting System

The advantages of using double entry accounting extend far beyond basic record-keeping and impact nearly every aspect of business financial management.

Improved Accuracy and Error Detection

Because every transaction requires balanced debits and credits, errors become immediately apparent when books don't balance. This built-in verification system catches mistakes that single entry accounting would miss, ensuring your financial records accurately reflect your business activities.

Fraud Prevention

Manipulating records is much more difficult when every transaction appears in multiple accounts. Removing or altering a single entry creates an imbalance that triggers investigation. This transparency makes double entry accounting an effective deterrent against internal fraud.

Comprehensive Financial Statements

Double entry accounting enables creation of balance sheets, income statements, and cash flow statements—the three core financial reports businesses need. These statements provide crucial insights for owners, investors, lenders, and tax authorities. Without double entry records, generating accurate financial statements would be impossible.

Better Decision Making

The detailed financial picture provided by double entry accounting supports informed business decisions. You can analyze profitability by product line, track expense trends over time, and understand your cash flow patterns. This analytical power helps you allocate resources effectively and identify areas for improvement.

Tax Compliance and Audit Readiness

Detailed transaction records make tax preparation easier and provide documentation if you're audited. Double entry accounting creates the paper trail tax authorities require and helps ensure you claim all legitimate deductions while accurately reporting income.

Limitations to Consider

While double entry accounting is the gold standard for business bookkeeping, it does have some drawbacks worth noting. The system is more complex than single entry and requires understanding of accounting principles, debits, credits, and account classifications. This learning curve can be steep for those without accounting backgrounds. Recording every transaction twice takes more time than single entry bookkeeping. For very small businesses with limited transactions, this additional effort may feel burdensome. Professional expertise or accounting software is typically necessary, adding costs that very small operations might find prohibitive. However, for most businesses, the benefits far outweigh these limitations.

Conclusion

Double entry accounting represents the foundation of modern financial record-keeping, providing accuracy, transparency, and comprehensive financial insights that single entry methods cannot match. By recording every transaction as both a debit and credit, this system creates self-balancing books that catch errors, prevent fraud, and enable creation of essential financial statements. Understanding what is double entry accounting empowers business owners and finance professionals to maintain accurate records, make informed decisions, and meet regulatory requirements. While the system requires learning and careful implementation, mastering double entry accounting is an investment that pays dividends through better financial management, stronger lending relationships, and clearer understanding of your business's true financial health.

Frequently Asked Questions

1. What is the main purpose of double entry accounting? The main purpose of double entry accounting is to ensure accuracy and completeness in financial records by recording every transaction in at least two accounts. This creates a self-balancing system where total debits always equal total credits, making errors immediately apparent. It also provides the foundation for creating comprehensive financial statements like balance sheets and income statements.

2. What is the difference between debits and credits in double entry accounting?

Debits are entries on the left side of the ledger that increase asset and expense accounts while decreasing liability, equity, and revenue accounts. Credits are entries on the right side that do the opposite—they increase liability, equity, and revenue accounts while decreasing asset and expense accounts. Every transaction requires equal debits and credits to keep books balanced.

3. Why do businesses use double entry instead of single entry accounting?

Businesses use double entry accounting because it provides more accurate records, better error detection, fraud prevention, and the ability to create comprehensive financial statements. Single entry only records transactions once, offering limited insight into financial position. Double entry is also required by GAAP and necessary for businesses seeking loans or investors.

4. Can small businesses use double entry accounting?

Yes, small businesses can and often should use double entry accounting. While it requires more effort than single entry, modern accounting software makes implementation manageable. The benefits of accurate records, proper financial statements, and easier tax preparation make double entry worthwhile for most businesses regardless of size.

5. How does double entry accounting prevent fraud?

Double entry accounting prevents fraud by creating multiple records of each transaction across different accounts. Altering or removing one entry creates an imbalance that becomes immediately visible when accounts are reconciled. This transparency and built-in verification system makes it much harder for individuals to manipulate financial records without detection.