Table of contents

- What Is Accrual Basis Accounting?

- What Is the Accrual Method of Accounting and How Does It Work?

- What Is the Difference Between Cash and Accrual Accounting?

- What Is an Accrual in Accounting? Types Explained

- Benefits of the Accrual Accounting Method

- When Should You Use Accrual Accounting?

- Challenges of Accrual Accounting

- Conclusion

Understanding what is accrual accounting is essential for business owners, accounting students, and finance professionals who want to gain an accurate picture of a company's financial health. Unlike simpler methods that only track cash as it moves in and out, accrual accounting captures the full scope of financial activity by recording transactions when they occur, not when payment happens. This approach provides clearer insights into profitability and is the standard method required by Generally Accepted Accounting Principles (GAAP) for most businesses.

What Is Accrual Basis Accounting?

What is accrual basis accounting? It's an accounting method that recognizes revenue in the period it's earned and expenses in the period they're incurred, regardless of when cash actually changes hands. This approach matches income with the expenses that helped generate it, providing a more accurate representation of a company's financial performance during any given period. The foundation of what is accrual based accounting lies in the matching principle—a core concept that requires revenue and related expenses to be recorded in the same accounting period. If you provide a service in December but receive payment in January, accrual accounting records that revenue in December when the work was completed. Similarly, if you incur an expense in one month but pay for it the next, the expense is recorded when it was incurred. This method is fundamentally different from cash accounting, where transactions are only recorded when money physically moves. For most businesses beyond simple sole proprietorships, accrual accounting provides the financial transparency needed for informed decision-making and regulatory compliance.

What Is the Accrual Method of Accounting and How Does It Work?

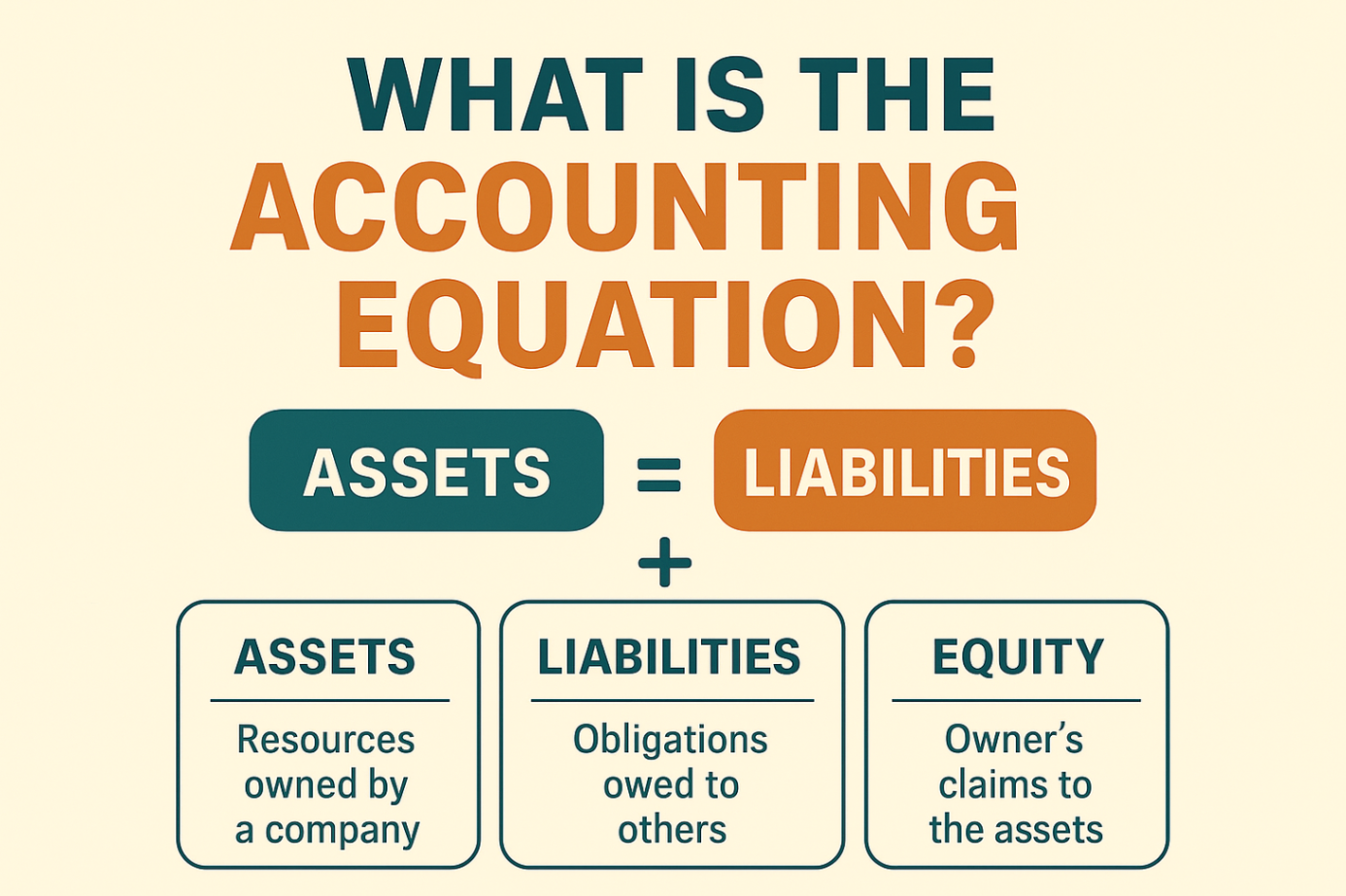

What is the accrual method of accounting in practice? This system works by creating placeholder accounts on your balance sheet that represent money you expect to receive or pay in the future. These accruals track upcoming cash transactions before they happen, giving you a complete view of your financial obligations and expected income. When you deliver a product or service, you record revenue immediately even if the customer hasn't paid yet. This creates an accounts receivable entry—an asset showing money owed to you. When you receive goods or services, you record the expense immediately even if you haven't paid yet. This creates an accounts payable entry—a liability showing money you owe. The accrual accounting method requires more detailed record-keeping than cash accounting because you're tracking both actual cash movements and expected future transactions. However, this additional complexity provides significant benefits in understanding your true financial position. Modern accounting software can automate much of this process, making accrual accounting accessible even for smaller businesses. This system relies on what is double entry accounting where every transaction affects at least two accounts with equal and opposite entries. This dual-recording system ensures your books always balance and creates automatic error detection when they don't.

What Is the Difference Between Cash and Accrual Accounting?

What is the difference between cash and accrual accounting? The fundamental distinction lies in timing—when transactions get recorded in your books. Cash accounting records revenue only when you receive payment and expenses only when you pay them. If a customer owes you $5,000, you don't record that income until the check arrives. If you owe a supplier $3,000, you don't record that expense until you pay the bill. This method is straightforward and shows exactly how much cash you have at any moment. Accrual accounting records revenue when earned and expenses when incurred, regardless of cash movement. That $5,000 the customer owes gets recorded as soon as you deliver the product or service. The $3,000 you owe the supplier gets recorded as soon as you receive their goods or services. Cash accounting works well for very small businesses with simple transactions and no inventory. However, it can distort your financial picture significantly. Imagine receiving a large payment in January for work done in December—cash accounting would show inflated January income and understated December income, making performance analysis misleading. Accrual accounting solves this problem by matching transactions to the periods they actually relate to. This provides much clearer insights into profitability trends and helps you make better business decisions. Most investors, lenders, and financial institutions prefer or require accrual-based financial statements because they provide a more accurate representation of company performance.

What Is an Accrual in Accounting? Types Explained

What is an accrual in accounting? Accruals are entries that record revenues earned but not yet received, or expenses incurred but not yet paid. These serve as placeholders on your balance sheet, reflecting upcoming cash transactions. There are four main types of accruals you'll encounter.

Accrued Revenue

Accrued revenue occurs when you've delivered goods or services but haven't received payment yet. This appears as an asset on your balance sheet because customers owe you money. For example, if you complete a consulting project in March but the client pays in April, you record accrued revenue in March when you earned it.

Deferred Revenue

Deferred revenue happens when you receive payment before delivering goods or services. This is recorded as a liability because you owe the customer something. If a client pays $12,000 upfront for a year-long subscription, you initially record this as deferred revenue, then recognize $1,000 each month as you provide the service.

Accrued Expenses

Accrued expenses arise when you've incurred costs but haven't paid for them yet. These appear as liabilities on your balance sheet. Common examples include utility bills that arrive after the service period, employee wages earned but not yet paid, and interest that accumulates on loans between payment dates.

Prepaid Expenses

Prepaid expenses occur when you pay for goods or services before receiving them. These are recorded as assets because you're entitled to future benefits. Insurance premiums paid annually in advance are a classic example—you record the full payment as a prepaid expense, then recognize a portion each month as the coverage period passes.

Benefits of the Accrual Accounting Method

What is accrual accounting method valued for? This approach offers numerous advantages that make it the preferred choice for most businesses and the required method under GAAP.

Accurate Financial Picture

Accrual accounting provides a more realistic view of profitability by matching revenues with related expenses in the same period. This clarity helps you understand which activities are actually generating profit and which are costing more than they return. You can analyze performance trends over time without the distortions that cash timing creates.

Better Cash Flow Management

Although accrual accounting doesn't directly track cash, it gives superior insight into upcoming payments and receivables. By seeing what customers owe you (accounts receivable) and what you owe suppliers (accounts payable), you can anticipate cash needs and plan accordingly. This foresight helps prevent cash shortages and enables strategic financial planning.

GAAP Compliance

Accrual accounting is the only method accepted under Generally Accepted Accounting Principles. Publicly traded companies must use this method, and the IRS requires it for businesses with over $25 million in average annual gross receipts. Even smaller businesses often adopt accrual accounting to prepare for growth or attract outside investment.

Enhanced Credibility

Lenders and investors view accrual-based financial statements as more credible and reliable. Because this method shows the complete financial picture—including obligations and expected income—stakeholders can better assess your company's true financial health. This improved credibility can help you secure financing or attract investors.

Strategic Planning Support

The forward-looking nature of accrual accounting supports better strategic planning. You can see predicted cash flows, anticipate seasonal patterns, and make informed decisions about expansion, hiring, or investments. This visibility helps company leaders position the business to maximize opportunities and avoid unexpected financial challenges.

When Should You Use Accrual Accounting?

Accrual accounting is ideal for businesses in several situations. If you offer credit terms to customers or use credit with suppliers, accrual accounting accurately tracks these transactions. Companies with inventory must use accrual methods to properly match cost of goods sold with sales revenue. Businesses with long-term contracts, subscriptions, or complex revenue structures benefit greatly from accrual accounting's accurate period matching. If you're planning to grow your business, seek investors, or apply for loans, using accrual accounting from the start builds consistency in your financial records. Even startups that begin with cash accounting typically switch to accrual methods when pursuing outside funding. For help understanding these concepts and applying them to your specific situation, resources like Accounting Homework Help can provide valuable guidance in mastering accrual accounting principles.

Challenges of Accrual Accounting

Despite its advantages, accrual accounting does present some challenges. The method is more complex than cash accounting, requiring understanding of accounting principles and careful attention to timing. Recording every transaction when it occurs rather than when cash moves demands more detailed record-keeping. Accrual accounting can also make cash flow less immediately visible since your income statement may show profit while your bank account shows limited cash. This disconnect requires additional monitoring of actual cash position alongside accrual-based reports. The complexity typically requires professional accounting help or robust accounting software, adding costs that very small businesses might find burdensome. However, for most businesses, the benefits of accurate financial reporting far outweigh these challenges.

Conclusion

Accrual accounting represents the standard for business financial reporting, providing an accurate and comprehensive picture of company performance by recognizing revenue when earned and expenses when incurred. This method aligns with GAAP requirements and offers superior insights for decision-making, cash flow planning, and stakeholder communication compared to cash-based alternatives. Understanding what is accrual accounting and how it works empowers business owners and finance professionals to maintain accurate records, comply with regulatory requirements, and make informed strategic decisions. While the method requires more detailed record-keeping and accounting expertise, mastering accrual accounting provides the foundation for sustainable business growth, improved credibility with lenders and investors, and clearer understanding of your company's true financial health over time.

Frequently Asked Questions

1. What is the main difference between accrual and cash accounting?

The main difference is timing of transaction recording. Accrual accounting records revenue when earned and expenses when incurred, regardless of cash movement. Cash accounting records transactions only when money actually changes hands. Accrual provides a more accurate picture of financial performance, while cash accounting shows only actual cash position at any moment.

2. Who is required to use accrual accounting?

Publicly traded companies must use accrual accounting under GAAP requirements. The IRS requires businesses with average annual gross receipts exceeding $25 million over three years to use this method. Additionally, any company that maintains inventory generally must use accrual accounting for tax purposes.

3. What are the four types of accruals?

The four main types are accrued revenue (income earned but not yet received), deferred revenue (payment received before delivering goods or services), accrued expenses (costs incurred but not yet paid), and prepaid expenses (payment made before receiving goods or services). Each type serves as a balance sheet placeholder for expected cash transactions.

4. Why do investors prefer accrual accounting?

Investors prefer accrual accounting because it provides a more accurate and complete view of a company's financial health. This method shows expected income, outstanding obligations, and true profitability by matching revenues with related expenses. This transparency enables better assessment of business performance and future prospects.

5. Can small businesses use accrual accounting?

Yes, small businesses can use accrual accounting and often benefit from doing so. While it requires more detailed record-keeping than cash accounting, modern accounting software makes implementation manageable. Small businesses planning to grow, seek financing, or attract investors particularly benefit from establishing accrual accounting practices early.